SSNIT’s announces 2026 Pension Boost: A 10% Increase Amid for Ghanaian’s Retirees

In a move aimed at safeguarding the financial well-being of Ghana’s retirees, the Social Security and National Insurance Trust (SSNIT) has announced a 10% average increase in monthly pension payments for 2026. This adjustment, effective from January 2026, affects all pensioners on the payroll as of December 31, 2025, and comes at a time when Ghana’s economy is showing signs of stabilization with inflation hitting a historic low of 5.4% in December 2025. As the nation grapples with post-pandemic recovery and global economic pressures, this indexation highlights SSNIT’s commitment to balancing pensioner protection with long-term fund sustainability. But is it enough? Let’s break down the details, historical context, reactions, and broader implications in this comprehensive overview.

Follow us on WhatsApp for more updates: CLICK HERE

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

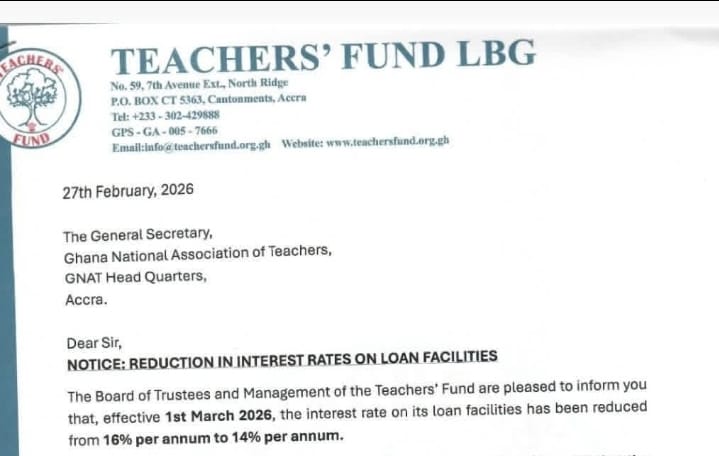

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Understanding the 2026 Pension Indexation: Key Details

SSNIT’s announcement, made during a press conference in Accra on January 8, 2026, follows consultations with the National Pensions Regulatory Authority (NPRA) and complies with Section 80 of the National Pensions Act, 2008 (Act 766). The 10% average increase is not a flat rate across the board; instead, it incorporates a redistribution mechanism to prioritize lower-income pensioners, ensuring greater equity.

- How the Increase Works: All pensioners receive a fixed 6% increase on their current payments, plus a flat amount of GH¢91.56 (representing the redistributed 4%). This progressive approach means lower earners get a proportionally larger boost.

- Minimum Pension Adjustments: For existing pensioners, the minimum monthly pension rises from GH¢300 to GH¢409.56 – a substantial 36.52% effective increase. New pensioners joining in 2026 will start at a minimum of GH¢400, up 33.3% from the previous floor.

- Impact on Average and High Earners: The average monthly pension, currently around GH¢2,018, will climb to approximately GH¢2,220. The highest-earning pensioner will see their payment jump from GH¢201,792.37 to GH¢213,991.47, reflecting a 6% effective rise.

- Total Expenditure and Reach: With about 261,920 pensioners on the payroll as of December 2025, the indexation will push annual pension payouts to over GH¢7 billion, up from GH¢6.3 billion without the increase – adding roughly GH¢616.6 million in costs. Monthly disbursements will exceed GH¢580 million.

SSNIT’s Director-General, Kwesi Afreh Biney, emphasized the scheme’s focus on fairness: “With inflation at 5.4% as of December, even the highest pensioner is covered, while those on the lower end are receiving real growth of up to 36%, which shows our commitment to fairness and protecting pension value.” Chief Actuary Evelyn Adjei added that the redistribution method “takes from those on high pensions and gives to those on low pensions,” underscoring the progressive nature of the adjustment.

Why This Increase? Factors and Economic Context

The 2026 indexation was determined by several variables, including salary growth among active contributors, a projected average inflation of 8% ± 2% by the end of 2025, and the fund’s long-term viability. Notably, the 10% rate outpaces the recent 5.4% inflation recorded in December 2025, signaling SSNIT’s intent to not just match but exceed price rises to preserve purchasing power.

Ghana’s inflation has been on a downward trajectory, dropping from 23.8% in December 2024 to 5.4% a year later – the lowest since July 2022 and marking 12 consecutive months of decline. This economic stability has allowed SSNIT to implement a “real growth” adjustment, as Biney noted: “It is also important to state that the current indexation is higher than the recent inflation rate. What that means is that every pensioner on the payroll has been covered by inflation.”

Additionally, SSNIT plans to expand its reach by adding over 200,000 new participants in 2026, building on its 2.1 million active contributors to bolster the scheme’s sustainability.

Historical Perspective: How Does 2026 Compare?

SSNIT’s pension indexations have varied with economic conditions over the years, often responding to inflation spikes:

| Year | Indexation Rate | Key Notes |

|---|---|---|

| 2026 | 10% (average) | Redistributed; minimum up 36.5% to GH¢409.56. |

| 2025 | 12% | Average increase; implemented with fixed and flat components similar to 2026. |

| 2023 | 25% | Higher rate amid elevated inflation. |

| Earlier Years | Varied (e.g., compliance focus in 2020-2021) | Growth in pensioners from 215,850 in 2019 to 227,407 in 2020; emphasis on fund growth. |

While 2026’s rate is lower than recent years, it reflects cooling inflation. However, historical trends show that during high-inflation periods (e.g., 2022-2024), adjustments have sometimes lagged, leading to cumulative erosion of purchasing power.

Reactions: Praise for Progressivity, Criticism for Inadequacy

The announcement has elicited mixed responses. On the positive side, the redistribution has been lauded for protecting vulnerable retirees, with Biney highlighting it as a “testament to our commitment to ensure that those at the lower end are as protected as possible.

However, critics argue it’s the “worst so far” due to structural flaws in the annual adjustment system, which responds slowly to inflation volatility. A Modern Ghana analysis points out that pensioners bore the brunt of double-digit inflation from 2022-2025, with full recovery taking years. It suggests alternatives like semi-annual true-ups or inflation triggers to share risks more equitably, potentially adding 8-20% cumulative boosts in past crises. Pensioner advocacy groups like Pensioners4Reforms echo calls for reforms to enhance transparency and adequacy.

Looking Ahead: Sustainability and Broader Implications

SSNIT’s expansion goals – targeting 90% compliance by 2026 and adding 200,000 contributors – are crucial for the fund’s health, especially as pensioners grew by 5.35% from 2019 to 2020 alone. With contributions reaching GH¢7.6 billion and payments over GH¢5 billion by September 2025, the scheme remains viable but faces pressures from an aging population.

For Ghana’s retirees, this increase provides immediate relief, particularly for the vulnerable. Yet, as inflation stabilizes, ongoing reforms could address criticisms and ensure pensions keep pace with real living costs. As one analyst noted, “The fall in inflation to 5.4% marks more than a statistical milestone – it signals a transition into a phase where price stability supports broader economic confidence.”

Follow us on WhatsApp for more updates: CLICK HERE

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services