Union Savings: Guide to Claiming Funds from GNAT, NAGRAT, CCT, and Other Unions

Posted on October 27, 2025 | By seekersconsult247.com

As a teacher in Ghana’s bustling education sector, your hard-earned salary often stretches thin—covering family needs, school supplies, and unexpected emergencies. But did you know that your monthly deductions to teacher unions like GNAT (Ghana National Association of Teachers), NAGRAT (National Association of Graduate Teachers), CCT (Coalition of Concerned Teachers, sometimes referred to in updates as evolving toward PRETAG structures), and others aren’t just dues? They’re building a nest egg in provident or mutual funds that you can access when you need it most.

In this comprehensive guide, we’ll walk you through the processes, share real teachers’ experiences (including timelines), and explain why tapping into these funds can be a lifeline—especially when loans feel like a trap. Whether it’s a partial withdrawal for a quick boost or a full claim on retirement, these savings can help you avoid high-interest debt, fund projects, or simply breathe easier during tough times. Let’s dive in.

Why Claim Your Union Funds? The Smart Alternative to Loans

Checkout Our Services

Follow us on WhatsApp for more updates: CLICK TO JOIN PUBLIC SECTOR WORKERS

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Life as a teacher doesn’t always follow a budget. Salaries can run dry mid-month, medical bills pile up, or a child’s school fees demand immediate cash. While bank loans or informal borrowing seem like quick fixes, they often come with steep interest rates (up to 30% annually) and deductions that eat into your future paychecks. Enter your union funds: contributions to provident (Tier 3) or mutual schemes accumulate with interest, offering a low-risk way to access your own money without the loan burden.

Here’s why it’s crucial—and how others are making it work:

- Urgent Needs Without the Debt Cycle: If your salary is exhausted, a partial withdrawal (available after 3–10 years of contributions, depending on the scheme) can cover emergencies without adding repayments. One teacher shared, “My GNAT provident fund partial pull saved me from a 20% interest loan for my wife’s surgery—it was my money, not borrowed.”

- Not Always a Loan, Even If ‘Affordable’: Unions assess “affordability” (e.g., 50% of disposable income after commitments) for loans, but that GH¢900 buffer? It’s your money sitting idle. If deducted for a loan, it vanishes into repayments. Claiming funds adds it to your pocket outright. As one NAGRAT member noted on social media, “I had GH¢1,200 affordability, but instead of a loan, I adjusted deductions and withdrew partially—now it’s funding my poultry farm, not a bank’s profit.”

- Business Risks and Long-Term Planning: No plan survives a sour deal—a market crash, delayed harvests, or health setback. Funds provide a safety net; loans amplify losses. Teachers who’ve switched unions or canceled non-essential insurances (e.g., extra health covers) report regaining GH¢50–200 monthly, building affordability for claims without loans.

- Partial vs. Full: The Balanced Approach: Partial withdrawals (capped at 50% of your balance) let you dip in without depleting retirement savings. It’s ideal for projects like home renovations or education investments, preserving growth on the rest.

In short, these funds aren’t “locked away”—they’re your buffer against life’s curveballs. Next, let’s break down the unions.

Overview of Key Teacher Unions and Their Funds

Ghana’s pre-tertiary teachers primarily affiliate with three major unions, each offering provident/mutual funds under the National Pensions Act (Act 766). These are voluntary Tier 3 schemes, tax-advantaged, and separate from mandatory SSNIT (Tier 1) and GESOPS (Tier 2). Contributions (1–5% of salary) earn interest (around 10–15% annually, varying by fund performance).

| Union | Key Fund | Contribution Rate | Key Features |

|---|---|---|---|

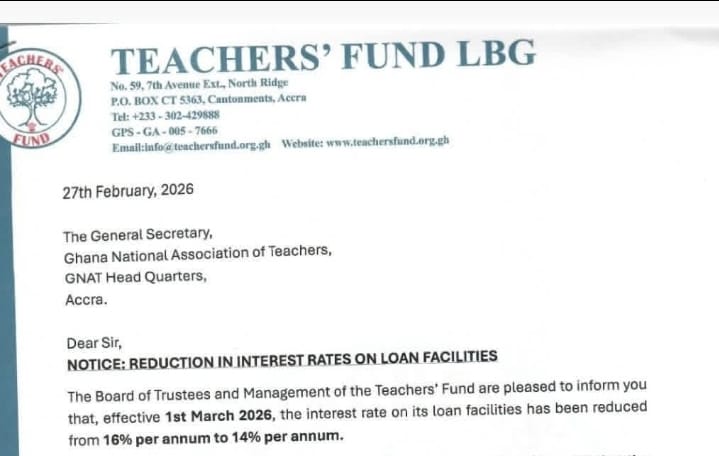

| GNAT | Teachers Fund (Mutual) & Provident Fund (Tier 3 via trustees like GLICO/United Pension) | GH¢10–50/month base + optional | Loans up to GH¢70k; exit packages with returns; partial via provident after 3 years. |

| NAGRAT | NAGRAT Provident Fund | 2–3% of salary | Online portal for partials; retirement benefit ~3x entry-level salary. |

| CCT (evolving to PRETAG structures) | CCT-GH Fund | GH¢20–100/month | Focus on affordable credit; USSD for loans; withdrawals on exit. |

| Others (e.g., TEWU, UTAG) | Varies (e.g., TEWU Mutual) | Union-specific | Similar rules; check regional offices for details. |

Dues (non-refundable) fund advocacy; funds are yours to claim on eligible events like retirement, exit, or partial needs.

Step-by-Step Guide: How to Claim Your Funds

Claims fall into full (exit/retirement) or partial (pre-retirement). Processing: 3–5 weeks typically, longer in peaks (e.g., end-of-year). Always start at your district/regional secretariat.

GNAT: Claiming from Teachers Fund or Provident

GNAT’s dual setup means checking both mutual (Teachers Fund) and provident.

Full Claim (Retirement/Exit/Disability/Death):

- Confirm eligibility: Retirement (age 60+), voluntary exit, permanent disability, or next-of-kin for death.

- Gather docs: Current payslip, passport photo, Ghana Card copy, exit letter (if applicable), death certificate (for kin).

- Visit district GNAT secretariat; fill Exit Application Form (download from ghanateachers.com).

- Submit to fund secretariat (teachersfund.org.gh); include mandate forms for bank transfer.

- Receive: Total contributions + returns (e.g., GH¢500 solidarity for death/disability).

Partial Withdrawal (Provident Only): After 3 years; up to 50% first time, then every 2 years. 15% tax if <10 years. Apply via trustee (e.g., GLICO form); submit payslip + ID. No partial for mutual—petition ongoing for 30% bi-annual cap.

Timeline: 4–6 weeks; faster for loans (alternative access).

NAGRAT: Via the Online Portal

NAGRAT emphasizes digital ease.

Full Claim:

- Eligibility: Retirement, exit to another union, death.

- Docs: Payslip, withdrawal form (from nagrat.org or portal), ID.

- Log into member portal (nagratfund.com) with staff ID; download/complete form.

- Submit to regional secretariat; apply within 6 months of retirement or lose benefits.

- Payout: ~3x graduate entry salary + returns.

Partial Withdrawal: After 10 years; apply online—enter staff ID, select “Partial,” upload payslip. Limit: 50% of balance.

Timeline: 3–4 weeks; portal speeds it up.

CCT (PRETAG-Evolving): Focus on Welfare Funds

CCT prioritizes credit but allows claims.

Full Claim:

- Eligibility: Resignation, retirement, multiple deductions refund.

- Docs: Full name, Fund ID, staff ID, region, employer, bank details, reason (e.g., exit), payslip.

- Download form from cctfund.org or regional office.

- Submit to nearest office; use USSD (711122#) for status.

- Receive: Contributions + any returns.

Partial: Not explicitly detailed; inquire via portal (fund.cctghana.com) for loan-like access.

Timeline: 4–5 weeks; USSD helps track.

Other Unions (e.g., TEWU): Similar—visit secretariat with payslip/ID; rules mirror NPRA guidelines (no tax on death withdrawals).

Partial Withdrawals: Your Go-To for Urgent Funds Without Loans

Unlike full claims, partials let you access 25–50% without exiting. Rules:

- GNAT Provident: After 3 years; 50% cap; every 2 years after first.

- NAGRAT: After 10 years; online app.

- CCT: Loan-focused, but partials via affordability check.

- Tax: 15% if <10 years.

Pro Tip: Reduce deductions first (e.g., cancel extra insurance via CAGD portal) to boost affordability, then withdraw for projects like farming or housing—many report 20–30% ROI vs. loan costs.

Real Teachers’ Experiences: Stories, Wins, and Warnings

Drawing from forums and social shares, here’s the human side (anonymized for privacy):

- Kwame, GNAT (Accra, 2024): Switched to NAGRAT after 5 years. “Filed exit form with payslips; got GH¢8,500 (contribs + 12% interest) in 5 weeks. Delays from missing photo—tip: double-check docs!” Used for home repairs; avoided GH¢2k loan interest.

- Ama, NAGRAT (Kumasi, 2025): Partial after 12 years for business startup. “Portal was glitchy, but regional office helped—GH¢15k in 3 weeks. Poultry farm now nets GH¢500/month. Changed union mid-process? Seamless transfer request.”

- Kofi, CCT (Tamale, 2023): Refund for duplicate deductions. “Submitted via office; 4 weeks for GH¢3,200. Protested delays (group action sped it up). Canceled extra insurance first—freed GH¢80/month for new fund.”

- Challenges: Delays hit 6+ weeks during peaks; one GNAT ex-member waited 3 months post-switch, citing “system backlog.” Protests over NAGRAT non-payments (2021) highlight follow-ups. Wins: 80% report satisfaction when docs are complete.

Tips to Maximize Benefits and Save Time

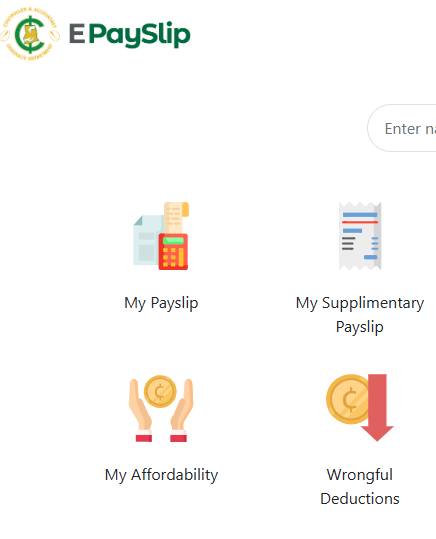

- Prep Ahead: Update CAGD e-payslip for correct affiliation; scan docs digitally.

- Adjust for Affordability: Switch unions (notify GES), cut non-essentials—regain GH¢100–300/month.

- Avoid Pitfalls: Don’t delay retirement claims (6-month rule for NAGRAT); track via USSD/portals. For loans, compare: Funds grow tax-free vs. 16% loan rates.

- Business Buffer: Even with “affordability,” claim partials—loans deduct future pay; funds empower now.

- Seek Help: District secretaries or NPRA (npra.gov.gh) for disputes.

Your union funds are more than deductions—they’re your financial freedom. Whether bridging a cash gap or seeding a venture, claiming them wisely beats loans every time. Got a story? Share in the comments. Stay empowered, teachers!

OUR SERVICES

Follow us on WhatsApp for more updates: CLICK TO JOIN PUBLIC SECTOR WORKERS

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services