Major Reforms in Ghana’s Student Loan System: SLTF Increases Amounts by 50% and Slashes Interest to 6%

In a significant move to make higher education more accessible and affordable for Ghanaian students, the Students Loan Trust Fund (SLTF) has rolled out sweeping reforms. Announced on November 7, 2025, these changes come as part of President John Dramani Mahama’s “Reset Agenda,” aimed at reducing financial barriers to tertiary education. With student loan amounts boosted by 50% and interest rates cut in half, this initiative is poised to benefit thousands of students across the country, fostering greater equity and inclusivity in academia.

- Southern Cross University RTP Scholarship 2025: Fully Funded Research Opportunities in Australia – Don’t Miss the October 31 Deadline!

- ERASMUS MUNDUS CLMCE give away Scholarship for 2026 – Fully Funded

- Nursing Scholarship from University of Toronto to all International students-Apply now

Follow us on WhatsApp for more updates: CLICK HERE

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

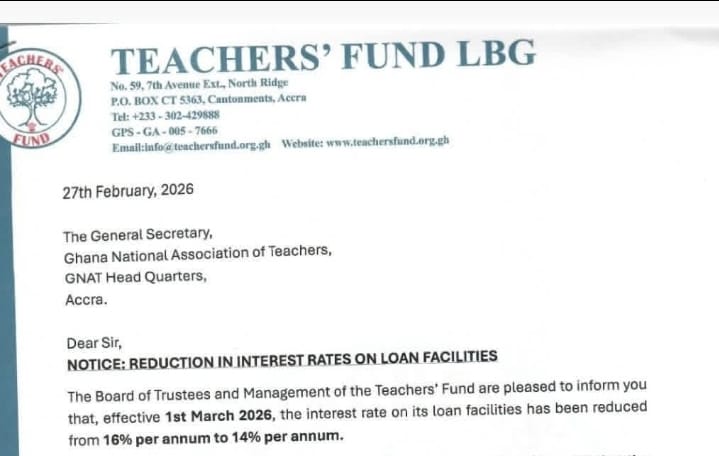

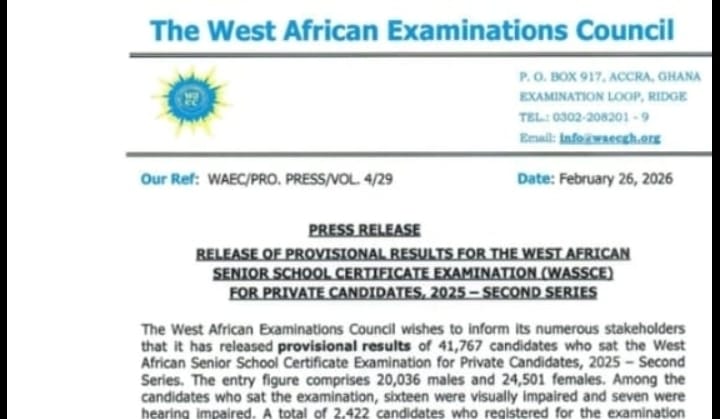

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

The Announcement: A Timely change for Tertiary Students

The SLTF, operating under the auspices of the Ministry of Education, made the official announcement through a statement signed by its Chief Executive Officer, Dr. Saajida Shiraz. The reforms follow a presidential directive to revise the student loan framework, addressing long-standing concerns about affordability and repayment burdens. Key highlights include increased loan disbursements, reduced interest rates, and streamlined application processes, all designed to ensure that no student is denied higher education due to financial constraints.

This comes hot on the heels of earlier hints from Education Minister Haruna Iddrisu, who, during a Public Accounts Committee session on November 3, 2025, signaled a review of interest rates to make them fairer for jobless graduates. The SLTF’s budget is also set to rise from GH¢70 million to GH¢150 million in 2026, further expanding access.

Key Reforms: Breaking Down the Changes

The reforms are multifaceted, targeting both the quantum of support and the ease of access. Here’s a detailed look at the main components:

1. 50% Increase in Loan Amounts

- Regular student loans, disbursed directly to students, have been hiked by 50%. Previously, amounts varied, but now they range from GH¢2,250 to GH¢4,500 per academic year, depending on the student’s needs and program.

- This adjustment aims to cover rising costs of living, tuition, and other educational expenses, providing “tangible relief” to students pursuing tertiary education.

2. Interest Rate Slashed to 6% Simple Interest

- One of the most applauded changes is the reduction in interest rates. The rate has been cut from 12% annual compound interest to 6% simple interest, applicable during the study period and the moratorium (grace) period post-graduation.

- Historically, the SLTF capped rates at 12% (linked to Ghana’s Treasury bill rates), but this slash addresses criticisms of compound interest accumulating unfairly on unemployed graduates. The new simple interest model makes repayment more manageable, potentially reducing default rates.

3. Streamlined Application and Disbursement Processes

- The cumbersome E-zwich requirement for loan applications has been eliminated, simplifying the process for applicants.

- New applicants will now have GCB Bank accounts automatically created within the No Fees Stress portal, enabling faster fund disbursement.

- Additionally, the introduction of the “Students Loan Plus” package under the No Fees Stress Initiative offers full fee coverage loans, disbursed directly to tertiary institutions, ensuring funds go straight to covering academic fees.

These updates build on recent SLTF engagements, such as discussions with the Ghana School of Law to extend loans to professional programs.

- Southern Cross University RTP Scholarship 2025: Fully Funded Research Opportunities in Australia – Don’t Miss the October 31 Deadline!

- ERASMUS MUNDUS CLMCE give away Scholarship for 2026 – Fully Funded

- Nursing Scholarship from University of Toronto to all International students-Apply now

Background: Evolution of the SLTF and the Need for Reform

The SLTF, established to provide subsidized loans to students in accredited tertiary institutions, has been a cornerstone of Ghana’s higher education financing since replacing the SSNIT Student Loans Scheme in 2005. Over the years, it has faced challenges like low repayment rates, funding shortfalls, and criticisms over high interest accumulation. For instance, interest was previously tied to the 182-day Treasury bill rate, capped at 12%, with compound calculations during in-school and grace periods.

Recent developments, including the expansion to law school students and increased reimbursements (e.g., GH¢139 million to 9,950 students in October 2025), set the stage for these reforms. The government’s push under the Reset Agenda reflects a broader commitment to education, aligning with calls for fairer terms amid economic pressures.

Potential Impact: Empowering Students and Boosting Education

These reforms are expected to have far-reaching effects:

- Increased Access: With higher loan amounts and lower interest, more students from low-income backgrounds can afford tertiary education, potentially boosting enrollment rates.

- Reduced Financial Stress: The shift to simple interest and full fee coverage via Students Loan Plus will ease repayment burdens, encouraging timely graduations and lower dropout rates.

- Economic Benefits: By investing in education, Ghana stands to gain a more skilled workforce, contributing to national development. The SLTF’s statement emphasizes this: “These reforms mark a significant milestone in supporting students… providing tangible relief.”

- Challenges Ahead: While promising, success depends on effective implementation, awareness campaigns, and sustained funding. Past issues with loan recovery highlight the need for robust monitoring.

A Step Toward Equitable Education in Ghana

The SLTF’s latest reforms represent a bold step forward in democratizing higher education in Ghana. By increasing loan amounts by 50%, slashing interest rates to 6%, and simplifying processes, the government is addressing key pain points for students. As Dr. Saajida Shiraz noted, the SLTF remains committed to “ensuring equitable access to affordable tertiary education.” For current and prospective students, this is an opportune moment to explore these options via the SLTF portal.

Stay tuned for updates, CLICK HERE and if you’re a student, visit www.sltf.gov.gh to apply.

- Southern Cross University RTP Scholarship 2025: Fully Funded Research Opportunities in Australia – Don’t Miss the October 31 Deadline!

- ERASMUS MUNDUS CLMCE give away Scholarship for 2026 – Fully Funded

- Nursing Scholarship from University of Toronto to all International students-Apply now

Follow us on WhatsApp for more updates: CLICK HERE

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services