NAGRAT GCB Loan Chart and Application Terms

The National Association of Graduate Teachers (NAGRAT) offers a robust loan program through its Fund Loan scheme, designed specifically for Teachers(members).

With competitive interest rates, flexible repayment terms, and straightforward application processes, NAGRAT loans have become a go-to option for members facing unexpected expenses, educational needs, or personal investments.

In this guide, we’ll dive deep into everything you need to know about NAGRAT loans—including the latest repayment chart, eligibility criteria, how to apply online, generating your mandate number, and even details on the partnership with GCB Bank for additional loan options.

Whether you’re a new member or a long-time contributor, this unique breakdown will help you navigate the system efficiently. We’ll also cover tips for responsible borrowing to ensure you make the most of these benefits without financial strain.

Note: Information is based on the most recent updates as of October 2025, including adjustments to minimum contributions and loan ceilings.

Here We go:

What is the NAGRAT Fund Loan (NFL)?

The NAGRAT Fund Loan (NFL) is a welfare initiative provided by the National Association of Graduate Teachers to support its members financially. Established to empower educators, the fund operates as a mutual savings and loan scheme where members contribute monthly dues that build their eligibility for loans.

Key features:

- Interest Rate: 12% per annum on a reducing balance basis. This means interest is only calculated on the outstanding principal, making it more affordable over time compared to flat-rate loans.

- Loan Purpose: Funds can be used for personal needs, such as home improvements, education, medical expenses, or emergencies.

- Repayment Method: Primarily through automatic salary deductions via the Government of Ghana (GoG) payroll system, ensuring hassle-free payments.

- Loan Tenure: Ranges from 6 to 48 months, depending on the principal amount.

- Maximum Loan Amount: Up to GHS 40,000, though this depends on your monthly fund contributions and affordability. For instance, the maximum you can realistically access with standard contributions is around GHS 30,000, as higher amounts require increased monthly dues (more on this below).

- Effective Date of Current Schedule: The repayment structure has been in place since September 2020, with minor updates for 2025, including adjusted minimum contributions.

Unlike commercial bank loans, NAGRAT’s scheme emphasizes member welfare, with profits reinvested into the fund for better benefits like retirement payouts.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/0029VaCyYGIFHWpx22L38a2K

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Eligibility Criteria for NAGRAT Loans

To qualify for a NAGRAT loan, you must meet specific requirements that ensure sustainability for both you and the fund. Here’s a breakdown:

- Membership Status: You must be an active, dues-paying member of NAGRAT. If you’re not yet a member, start by joining the union (see the application section below).

- Fund Contributions:

- Minimum monthly contribution: GHS 105 (updated from the previous GHS 55 to account for inflation and fund growth as of 2025).

-

- For loans up to GHS 20,000: The minimum GHS 105 contribution suffices.

-

- For higher amounts (e.g., GHS 30,000): You’ll need to increase your contributions to around GHS 200 monthly. This builds your “affordability score” and demonstrates commitment.

-

- Contribution Duration: New members must contribute consistently for at least 6 months before applying.

-

- This waiting period helps establish your reliability and allows the fund to grow.

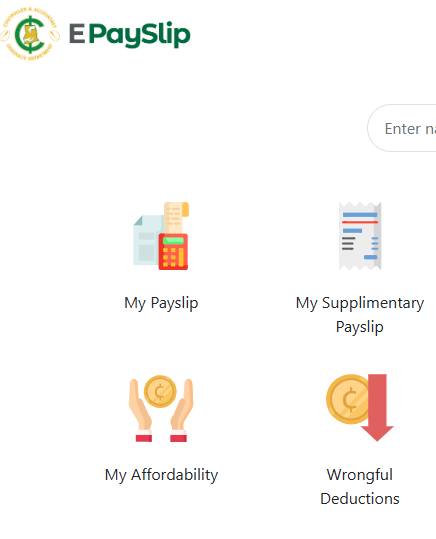

- Affordability Check: Your loan amount is capped based on your salary (verified via the GoG e-payslip system). Typically, repayments shouldn’t exceed 40-50% of your net salary to avoid overburdening.

- No Outstanding Defaults: You must be up-to-date on any previous NAGRAT dues or loans. If you have 3 months or fewer left on an existing loan, you may not qualify for a new one or top-up until it’s cleared.

- Guarantor Requirement: A fellow NAGRAT member (with updated portal details) must guarantee your loan.

If you’re a new teacher or switching from another union (e.g., GNAT), prioritize setting up your contributions early to unlock loan access sooner.

NAGRAT Loan Repayment Chart and Terms

The NAGRAT repayment schedule is transparent and tiered based on the principal amount and duration. Below is the detailed chart effective for 2025 (based on the 12% interest rate). It includes principal, duration (in months), interest, total repayment, and monthly deduction. This structure allows for predictable budgeting—repayments are deducted monthly from your salary.

Use this chart to estimate your costs. For example, a GHS 10,000 loan over 12 months incurs GHS 1,200 in interest, totaling GHS 11,200 with monthly payments of GHS 933.33.

| S/N | Principal (GHS) | Duration (Months) | Interest on Loan (GHS) | Total Repayment (GHS) | Monthly Deduction (GHS) |

|---|---|---|---|---|---|

| 1 | 1,000.00 | 6 | 60.00 | 1,060.00 | 176.67 |

| 2 | 1,500.00 | 10 | 150.00 | 1,650.00 | 165.00 |

| 3 | 2,000.00 | 12 | 240.00 | 2,240.00 | 186.67 |

| 4 | 3,000.00 | 12 | 360.00 | 3,360.00 | 280.00 |

| 5 | 4,000.00 | 12 | 480.00 | 4,480.00 | 373.33 |

| 6 | 5,000.00 | 12 | 600.00 | 5,600.00 | 466.67 |

| 7 | 6,000.00 | 12 | 720.00 | 6,720.00 | 560.00 |

| 8 | 7,000.00 | 12 | 840.00 | 7,840.00 | 653.33 |

| 9 | 8,000.00 | 12 | 960.00 | 8,960.00 | 746.67 |

| 10 | 9,000.00 | 12 | 1,080.00 | 10,080.00 | 840.00 |

| 11 | 10,000.00 | 12 | 1,200.00 | 11,200.00 | 933.33 |

| 12 | 3,000.00 | 18 | 540.00 | 3,540.00 | 196.67 |

| 13 | 4,000.00 | 18 | 720.00 | 4,720.00 | 262.22 |

| 14 | 5,000.00 | 18 | 900.00 | 5,900.00 | 327.78 |

| 15 | 6,000.00 | 18 | 1,080.00 | 7,080.00 | 393.33 |

| 16 | 7,000.00 | 18 | 1,260.00 | 8,260.00 | 458.89 |

| 17 | 8,000.00 | 18 | 1,440.00 | 9,440.00 | 524.44 |

| 18 | 9,000.00 | 18 | 1,620.00 | 10,620.00 | 590.00 |

| 19 | 10,000.00 | 18 | 1,800.00 | 11,800.00 | 655.56 |

| 20 | 3,000.00 | 24 | 720.00 | 3,720.00 | 155.00 |

| 21 | 4,000.00 | 24 | 960.00 | 4,960.00 | 206.67 |

| 22 | 5,000.00 | 24 | 1,200.00 | 6,200.00 | 258.33 |

| 23 | 6,000.00 | 24 | 1,440.00 | 7,440.00 | 310.00 |

| 24 | 7,000.00 | 24 | 1,680.00 | 8,680.00 | 361.67 |

| 25 | 8,000.00 | 24 | 1,920.00 | 9,920.00 | 413.33 |

| 26 | 9,000.00 | 24 | 2,160.00 | 11,160.00 | 465.00 |

| 27 | 10,000.00 | 24 | 2,400.00 | 12,400.00 | 516.67 |

| 28 | 4,000.00 | 30 | 1,200.00 | 5,200.00 | 173.33 |

| 29 | 5,000.00 | 30 | 1,500.00 | 6,500.00 | 216.67 |

| 30 | 6,000.00 | 30 | 1,800.00 | 7,800.00 | 260.00 |

| 31 | 7,000.00 | 30 | 2,100.00 | 9,100.00 | 303.33 |

| 32 | 8,000.00 | 30 | 2,400.00 | 10,400.00 | 346.67 |

| 33 | 9,000.00 | 30 | 2,700.00 | 11,700.00 | 390.00 |

| 34 | 10,000.00 | 30 | 3,000.00 | 13,000.00 | 433.33 |

| 35 | 5,000.00 | 36 | 1,800.00 | 6,800.00 | 188.89 |

| 36 | 6,000.00 | 36 | 2,160.00 | 8,160.00 | 226.67 |

| 37 | 7,000.00 | 36 | 2,520.00 | 9,520.00 | 264.44 |

| 38 | 8,000.00 | 36 | 2,880.00 | 10,880.00 | 302.22 |

| 39 | 9,000.00 | 36 | 3,240.00 | 12,240.00 | 340.00 |

| 40 | 10,000.00 | 36 | 3,600.00 | 13,600.00 | 377.78 |

| 41 | 8,000.00 | 42 | 3,360.00 | 11,360.00 | 270.48 |

| 42 | 9,000.00 | 42 | 3,780.00 | 12,780.00 | 304.29 |

| 43 | 10,000.00 | 42 | 4,200.00 | 14,200.00 | 338.10 |

| 44 | 12,000.00 | 42 | 5,040.00 | 17,040.00 | 405.71 |

| 45 | 14,000.00 | 42 | 5,880.00 | 19,880.00 | 473.33 |

| 46 | 15,000.00 | 42 | 6,300.00 | 21,300.00 | 507.14 |

| 47 | 18,000.00 | 42 | 7,560.00 | 25,560.00 | 608.57 |

| 48 | 20,000.00 | 42 | 8,400.00 | 28,400.00 | 676.19 |

| 49 | 15,000.00 | 48 | 7,200.00 | 22,200.00 | 462.50 |

| 50 | 15,000.00 | 36 | 5,400.00 | 20,400.00 | 566.67 |

| 51 | 17,000.00 | 36 | 6,120.00 | 23,120.00 | 642.22 |

| 52 | 18,000.00 | 36 | 6,480.00 | 24,480.00 | 680.00 |

| 53 | 18,000.00 | 48 | 8,640.00 | 26,640.00 | 555.00 |

| 54 | 20,000.00 | 36 | 7,200.00 | 27,200.00 | 755.56 |

| 55 | 20,000.00 | 48 | 9,600.00 | 29,600.00 | 616.67 |

| 56 | 25,000.00 | 36 | 9,000.00 | 34,000.00 | 944.44 |

| 57 | 25,000.00 | 48 | 12,000.00 | 37,000.00 | 770.83 |

| 58 | 30,000.00 | 48 | 14,400.00 | 44,400.00 | 925.00 |

| 59 | 35,000.00 | 48 | 16,800.00 | 51,800.00 | 1,079.17 |

| 60 | 40,000.00 | 48 | 19,200.00 | 59,200.00 | 1,233.33 |

Terms to Note:

- Interest is calculated monthly on the reducing balance.

- Early repayment is allowed without penalties, but check for any admin fees.

- Defaulting may affect future eligibility and could lead to legal recovery actions.

How to Apply for a NAGRAT Loan: Step-by-Step Guide

Applying for a NAGRAT loan is primarily online, making it convenient for busy teachers. Here’s the detailed process:

- Join NAGRAT if Not a Member:

- Visit https://www.gogpayslip.com/ and log in (or register if new).

- Click “Change Association” and select NAGRAT.

- Download membership forms from https://www.nagrat.org/ or pick them up at a regional secretariat.

- Submit the completed form to your nearest NAGRAT office.

- Set Up Fund Contributions:

- Once a member, log into the NAGRAT Fund portal at https://www.nagratfund.com/.

- Use your Staff ID as username; if first time, click “Forget Password” to receive a reset code via SMS.

- Update your profile and start contributions (minimum GHS 105/month via salary deduction).

- Prepare Documents:

- Two passport-sized photos.

- Ghana Card (colored copy).

- Recent payslip.

- Mandate forms (two with different serial numbers—see next section).

- Affordability form from e-payslip.

- Apply Online:

- Log into https://www.nagratfund.com/.

- Upload your records (payslip, mandate forms).

- Select “Apply for Loan.”

- Enter the loan amount, duration, and bank details.

- Input your guarantor’s Staff ID (they’ll receive an OTP code—request it from them).

- Confirm details and submit.

- Review and Disbursement:

- Applications are processed within 2-4 weeks (faster for repeat borrowers).

- Upon approval, funds are transferred to your bank account.

- Track status via the portal.

Processing times can vary, but as of 2025, NAGRAT aims for efficiency with digital submissions.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/0029VaCyYGIFHWpx22L38a2K

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

How to Generate Your Mandate Number for NAGRAT Loan

The mandate number is a unique serial code required for payroll deductions. It’s generated via the Government of Ghana’s e-payslip system and comes with an OTP for security. You’ll need two mandate numbers (with different serials) for your application.

Step-by-Step:

- Visit https://www.gogpayslip.com/ and log in using your Staff ID and password.

- Navigate to “Generate Mandate Form” or “Third-Party Deductions.”

- Select NAGRAT Fund Loan as the deduction type.

- Enter the loan details (amount, duration) for affordability check.

- Click “Generate”—the system will produce a mandate number and send an OTP via SMS.

- Repeat the process for a second mandate (use a different session or refresh).

- Download and print the forms, sign them, and upload during your loan application.

Tips: If OTP doesn’t arrive, check your registered phone number or resend. This step is crucial as it authorizes salary deductions.

NAGRAT-GCB Loan Partnership: Additional Options for Members

In addition to the core NFL, NAGRAT partners with GCB Bank to offer enhanced loan facilities for members with GCB salary accounts. This collaboration provides an alternative for those needing larger amounts or different terms.

Key Details (as of 2025):

- Interest Rate: 20% (reduced from standard GCB rates of 22% for NAGRAT members).

- Maximum Amount: Up to GHS 700,000, but subject to affordability (higher than NFL).

- Tenure: Up to 60 months.

- Eligibility: Must have a GCB salary account; non-GCB customers can switch.

- Application: Fill GCB loan forms, get endorsed at NAGRAT head office, and submit to GCB Branch. Call GCB for validation before applying.

- Benefits: Faster disbursement (under 24 hours possible), insurance cover, and flexible use.

If you’re not with GCB, consider switching for this perk. Contact NAGRAT or GCB for forms and random outreach calls about products.

- Calculate Affordability: Use online calculators or the chart above to simulate repayments.

- Increase Contributions Early: For larger loans, bump up to GHS 200+ months in advance.

- Avoid Overborrowing: Stick to needs—remember, loans affect your net salary.

- Monitor Your Portal: Update details regularly to avoid delays.

- Seek Advice: Consult your regional NAGRAT secretariat for personalized guidance.

- Compare Options: If NFL doesn’t fit, explore the GCB partnership or alternatives like GNAT loans (18% interest).

NAGRAT loans offer a lifeline for Ghanaian teachers, blending low rates, member-focused terms, and easy access. By contributing consistently and following the application steps, you can secure funding without the hassles of traditional banking. Remember, responsible borrowing is key to long-term financial health.

For the latest updates, visit https://www.nagrat.org/ or https://www.nagratfund.com/. If you have questions, reach out to NAGRAT support. Start your application today and take control of your finances in 2025!

pro tip; all the unions you can join, consider them for loan first before you look outside.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/0029VaCyYGIFHWpx22L38a2K

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Serve with integrity with Professionalism