Guide to Student Loans for International Students from Nigeria, Ghana, India, and Beyond

Studying abroad opens doors to world-class education, diverse cultures, and enhanced career prospects.

However, financing this dream can be a significant hurdle for international students, especially those from developing countries like Nigeria, Ghana, and India.

Traditional lenders often require cosigners, collateral, or established credit history—barriers that many face. Fortunately, specialized companies have emerged to bridge this gap, offering loans tailored to international students without these stringent requirements.

In this blog, we’ll explore a curated list of reputable companies providing such loans.

For Your Transcript and Evaluations Contact Us; 0550414552

We’ll delve into their offerings, eligibility criteria, and real-world verification through reviews, success stories, and user experiences. This is based on extensive research from reliable sources, including company websites, review platforms, and social media discussions.

Whether you’re a Nigerian aspiring to study in the US, a Ghanaian heading to Canada, or an Indian pursuing a master’s in the UK, these options can help make your goals achievable.

Note that interest rates and terms can vary, so always check current details and consult financial advisors.

group of diverse international students discussing education opportunities, symbolizing access to loans for studying abroad

Why International Student Loans Matter

International students often ineligible for federal aid in host countries like the US or Canada must turn to private lenders. These loans cover tuition, living expenses, books, and sometimes travel.

Key advantages include no need for local cosigners (in many cases), flexible repayment based on future earnings, and additional perks like visa support or career guidance. However, they come with higher interest rates (typically 9-15%) due to the perceived risk.

From user experiences, many have benefited immensely: loans enable enrollment in top universities, build credit history, and lead to high-paying jobs post-graduation, allowing quick repayment.

For instance, one Indian alum paid off a 15 lakh INR loan within 20 months through part-time work and internships. Success rates are high—91% of borrowers report loans as crucial to their studies.

Top Companies Offering Loans to International Students

Below is a table summarizing key lenders, focusing on those accessible to students from Nigeria, Ghana, India, and similar regions. We’ve prioritized no-cosigner options for broader accessibility. Data is verified from official sites and reviews as of October 2025.

| Company | Target Students | Key Features | Interest Rates | Eligibility | Verified Benefits & Reviews |

|---|---|---|---|---|---|

| MPOWER Financing | Global (190+ countries, incl. Nigeria, Ghana, India) | Fixed-rate loans $2,001–$100,000; covers US/Canada studies; no cosigner/collateral; 10-year repayment; visa support, scholarships, career tools. | 9.99%+ (10.89% APR with autopay discount) | Enrolled in eligible US/Canada school; future potential-based approval; apply worldwide. | High satisfaction (96% happy; 4.7/5 on Trustpilot from 3,000+ reviews). Nigerian student Leonard praised support during approval. Ghanaian Yoofi got visa approval thanks to timely funding. Indian Abhinandan noted fast processing without collateral. Real lender; helped 20,000+ students. A+ BBB rating. |

| Prodigy Finance | Global (120+ countries, incl. Nigeria, Ghana, India) | Master’s loans up to $220,000; no collateral; co-signer optional (esp. for Indians); covers US/UK/Europe; future earnings-based. | 9.09%+ variable (co-signer); 10.26%+ general. | Enrolled in 1,800+ top schools; quick eligibility check. | Funded 45,000+ students; excellent Trustpilot rating. Users highlight no-collateral access for top unis, building credit abroad. One borrower repaid over 10-20 years at $500/month. Warm reps and UI praised in GMAT Club reviews. Multiple clients from Nigeria/Ghana succeeded. |

| 8B Education Investments | African (Nigeria, Ghana, Kenya, etc.) | Fair loans via US bank partnership; covers tuition/living; no cosigner/collateral; $111M+ program. | Not specified (competitive, fair options). | Ambitious Africans at global unis; bootcamps for prep. | Addresses funding gaps (2/3 Africans fail to enroll without it). Kenyan Dancan gained housing assurance for success. Tanzanian Nifasha funded MPH at Boston U. Ugandan Kevin avoided dropping dreams. Positive for no US credit needed; community support. |

| Leap Finance | Indian students abroad | Low-interest loans; no collateral; 100% coverage for US/UK/Canada; quick sanction (3 days). | 9.75%+ (varies). | Indian citizens enrolled abroad; online process. | 4/5 on Trustpilot; fast, transparent. User repaid smoothly; better than Prodigy for no prep fees. Secure for abroad studies. |

| Avanse Financial Services | Indian students abroad | Secured/unsecured loans INR 1L–1.25Cr; 100% tuition/75% living; 51 countries. | Floating 14.55%+ spread. | Indian citizens 18+ with admission; co-borrower required. | Supported 64,800+ students; quick 3-day sanctions. Flexible repayments up to 17 years; holistic funding praised. |

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application ( College, UEW, UCC, KNUST ) and Evaluation

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Other notable mentions:

- For Nigerians/Ghanaians: edXtra (up to $100K for US/UK/Europe); MOD Education ($25K tuition).

- For Indians: SBI Global Ed-Vantage (above Rs. 20L, abroad courses); ICICI (up to Rs. 3Cr); HDFC (over Rs. 20L).

- General: Ascent Funding (intl with cosigner); Earnest (competitive APRs).

So we checked their legitimate value

Verifying Legitimacy and Real Benefits

To ensure these are genuine, we cross-verified via official sites, Trustpilot, Reddit, and X posts. All listed companies are established with positive track records—no major scams reported.

- MPOWER: Legit per Reddit; high rates but reliable. Benefits: Builds US credit; 91% say essential. Ghanaian success story: Funded studies, led to visa.

- Prodigy: Honest reviews note high demand for no-collateral; helped intl without credit. Benefits: Flexible terms; users report career boosts.

- 8B: Revolutionary for Africans; first US bank partnership. Benefits: Scholars like Levis gained mentorship, succeeding abroad.

- Leap/Avanse: Indian users praise speed and coverage; repaid via jobs abroad. Benefits: No burden on family; 100% financing.

From X: Multiple users shared lists and personal wins, e.g., Nigerians getting $100K via MPOWER. High interest (15%) is a con, but no alternatives without cosigners.

Tips for Applying and Maximizing Benefits

- Research Thoroughly: Use comparison tools like InternationalStudentLoan.com.

- Seek Scholarships First: Combine with loans (e.g., Erasmus Mundus).

- Work Part-Time: Many repay quickly via jobs/internships.

- Budget Wisely: Factor in high rates; aim for short terms.

- Verify Visa Impact: Loans provide proof of funds.

- Avoid Scams: Stick to verified lenders; check BBB/Trustpilot.

These companies have empowered thousands— from Nigerians funding US degrees to Indians thriving in Europe. While costs are higher, the ROI in education and careers is substantial. Start by checking eligibility on their sites. Your global journey awaits! If you’re from these regions, share your experiences in the comments.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application ( College, UEW, UCC, KNUST ) and Evaluation

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

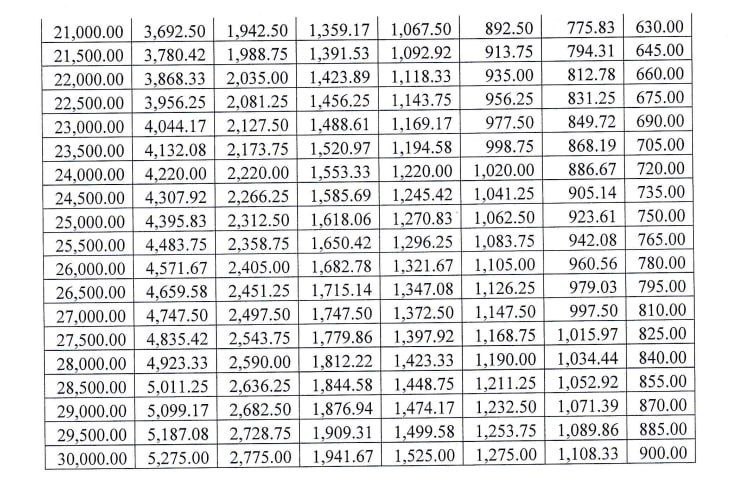

REPAYMENT FOR MPOWER LOAN

Student Loan Repayment Guide for MPOWER Financing

This guide provides detailed information on loan repayment options for students in the U.S. and Canada, including international students, U.S. citizens, U.S. permanent residents, and DACA recipients. Note that MPOWER Financing student loans do not support Canadian citizens studying in Canada.

Key Definitions

-

International Students: Non-U.S. citizens or non-permanent residents studying at a university in the U.S., or non-Canadian citizens or non-permanent residents studying at a university in Canada.

-

DACA: Deferred Action for Childhood Arrivals, a program initiated by the U.S. Department of Homeland Security in 2012. To qualify, students must have applied for and been granted DACA status by the United States Citizenship and Immigration Services (USCIS).

-

Annual Percentage Rate (APR): The annual cost of a loan, including interest rate and fees, expressed as a percentage. APR allows for an “apples-to-apples” comparison across loan products and providers.

Student Loans for U.S. and Canada

MPOWER Financing offers fixed-rate loans for international students, U.S. citizens, U.S. permanent residents, and DACA recipients studying in the U.S. or Canada. The interest rate remains constant throughout the loan term. Borrowers can qualify for a 0.25% rate discount by enrolling in automatic loan payments through bank account withdrawal.

Interest Rates and APRs (Without Discount)

The following rates apply for a $10,000 loan without the automatic payment discount:

-

10.24% Interest Rate (11.15% APR) with a 5% origination fee:

-

Monthly payment: $89.60 for the first 30 months (interest-only during in-school and grace period).

-

Monthly payment: $140.16 for the next 120 months (principal and interest).

-

-

14.24% Interest Rate (15.57% APR) with a 6.5% origination fee:

-

Monthly payment: $126.38 for the first 30 months.

-

Monthly payment: $166.90 for the next 120 months.

-

-

16.99% Interest Rate (18.88% APR) with an 8.5% origination fee:

-

Monthly payment: $153.62 for the first 30 months.

-

Monthly payment: $188.50 for the next 120 months.

-

Interest Rates and APRs (With Discount)

By enrolling in automatic debit immediately after loan disbursement and maintaining it for the loan’s duration, borrowers receive a 0.25% interest rate reduction. For a $10,000 loan:

-

9.99% Interest Rate (10.89% APR) with a 5% origination fee:

-

Monthly payment: $87.41 for the first 30 months.

-

Monthly payment: $138.70 for the next 120 months.

-

-

13.99% Interest Rate (15.31% APR) with a 6.5% origination fee:

-

Monthly payment: $124.16 for the first 30 months.

-

Monthly payment: $165.29 for the next 120 months.

-

-

16.74% Interest Rate (18.62% APR) with an 8.5% origination fee:

-

Monthly payment: $151.36 for the first 30 months.

-

Monthly payment: $186.79 for the next 120 months.

-

Repayment Structure

-

In-School and Grace Period: Students make interest-only payments for up to 30 months (2.5 years) while enrolled full-time and during the grace period. Payments begin 45 days after loan disbursement.

-

Post-Grace Period: After the grace period, borrowers make principal and interest payments based on a 120-month amortization schedule.

-

Assumptions: The above calculations assume no forbearance, deferment, or prepayment of principal, and all payments are made on time.

Loan Refinancing in the U.S.

MPOWER offers refinancing options for international students, U.S. citizens, U.S. permanent residents, and DACA recipients in the U.S. Refinancing allows borrowers to consolidate existing loans into a new loan with a fixed interest rate.

Interest Rates and APRs (Without Discount)

For a $10,000 refinanced loan without the automatic payment discount:

-

10.24% Interest Rate (11.77% APR) with a 6.5% origination fee:

-

Monthly payment: $142.16 for 120 months.

-

-

11.24% Interest Rate (12.80% APR) with a 6.5% origination fee:

-

Monthly payment: $148.15 for 120 months.

-

-

12.24% Interest Rate (13.84% APR) with a 6.5% origination fee:

-

Monthly payment: $154.28 for 120 months.

-

Interest Rates and APRs (With Discount)

With the 0.25% rate discount for automatic debit:

-

9.99% Interest Rate (11.52% APR) with a 6.5% origination fee:

-

Monthly payment: $140.68 for 120 months.

-

-

10.99% Interest Rate (12.55% APR) with a 6.5% origination fee:

-

Monthly payment: $146.64 for 120 months.

-

-

11.99% Interest Rate (13.58% APR) with a 6.5% origination fee:

-

Monthly payment: $152.74 for 120 months.

-

Repayment Structure

-

Payments begin 45 days after loan disbursement.

-

Repayments are calculated using a 120-month amortization schedule.

-

Assumptions: No forbearance, no prepayment of principal, and all payments are made on time.

Notes

-

Origination Fees: These are one-time fees charged at loan disbursement, included in the APR calculation. For example, a 6.5% origination fee on a $10,000 loan adds $650 to the loan cost.

-

Automatic Payment Discount: To qualify, borrowers must enroll in automatic debit immediately after loan disbursement and maintain it for the loan’s duration.

-

Fixed Rates: All interest rates are fixed and will not increase over the life of the loan.

This guide can help you understand the repayment structure and costs associated with MPOWER Financing loans, enabling you to make informed decisions for your education funding.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Turnitin checker (Plagiarism and AI checker)

Transcript Application ( College, UEW, UCC, KNUST ) and Evaluation

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

I want to apply for the college of education schoolers ship

I want to apply for the college of education schoolers ship