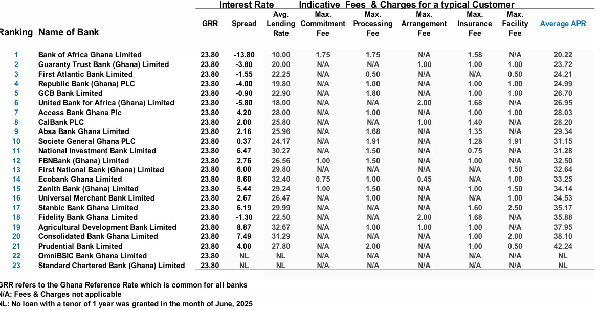

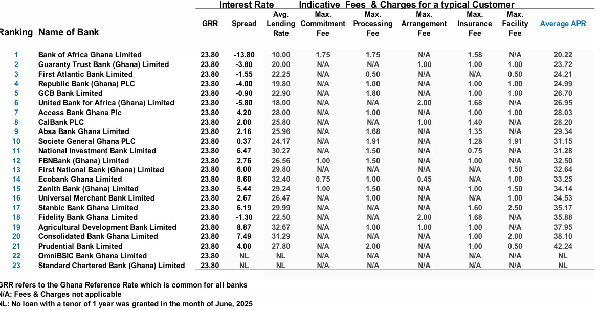

Ghana Bank Lending Rates: A Snapshot of Household Loan Costs in August 2025

As Ghana continues its battle against inflation, the Bank of Ghana has been implementing measures to stabilize interest rates. While some financial institutions have reduced their lending rates effective August 2025, many rates remain stubbornly high, putting pressure on household budgets and business operations.

Current Lending Landscape

The Ghana Reference Rate (GRR) stands at 23.50% for all banks, serving as the benchmark for loan pricing. However, the actual cost to borrowers varies significantly between institutions when factoring in spreads and additional fees.

Selected Bank Lending Rates (Household Loans)

Here are the current rates from some major Ghanaian banks:

| Bank | Base Lending Rate | Spread | Average APR |

|---|---|---|---|

| Bank of Africa Ghana Limited | 10.00% | -13.38% | 20.32% |

| Guaranty Trust Bank (Ghana) | 20.00% | -3.88% | 22.72% |

| First Marine Bank Limited | 23.25% | -1.58% | 24.71% |

| Republic Bank (Ghana) PLC | 19.50% | -4.88% | 24.99% |

| GCB Bank Limited | 18.50% | -12.90% | 26.79% |

| Access Bank Ghana Plc | 18.50% | -4.28% | 29.63% |

| Ecobank Ghana Limited | 32.40% | 6.06% | 33.25% |

| Fidelity Bank Ghana Limited | 23.50% | -1.38% | 35.98% |

| Agricultural Development Bank | 32.67% | 6.87% | 37.95% |

Follow us on WhatsApp for more updates: https://whatsapp.com/channel/0029VaCyYGIFHWpx22L38a2K

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

Key Observations

-

Wide Rate Disparity: There’s a significant gap between the lowest APR (20.32% at Bank of Africa) and the highest (37.95% at Agricultural Development Bank).

-

Fee Impact: Many banks add substantial fees (processing, arrangement, insurance) that increase the true cost of borrowing beyond the base rate.

-

Positive Spreads Emerging: Some banks now have positive spreads above the GRR, particularly:

-

Service General Ghana PLC (+6.47%)

-

National Investment Bank (+6.47%)

-

First National Bank (+6.06%)

-

-

Non-Lending Institutions: Standard Chartered Bank and Omnilistic Bank currently show no lending activity (“NL”) for household loans.

What This Means for Borrowers

While the central bank’s efforts have brought some relief, many rates remain elevated. Borrowers should:

-

Compare both the base rate AND the full APR (which includes fees)

-

Negotiate with lenders, especially if they have good credit history

-

Consider shorter-term loans if possible, as rates may continue to moderate

-

Watch for special promotions as banks compete for quality borrowers

The Bank of Ghana’s continued focus on inflation control suggests we may see further rate adjustments in coming months. Households and businesses should stay informed and consult financial advisors before committing to significant loan obligations.

Data reflects rates as of August 2025. Always verify current rates directly with financial institutions before making borrowing decisions.