Can Someone Take a Loan With Your CAGD E-payslip Details Without Your Consent? And Phone Number

The digital age has revolutionized loan applications, making them faster and more convenient. However, this ease has also raised concerns about security, particularly regarding access to personal financial information. A common question among government workers using the Controller and Accountant General’s Department (CAGD) E-payslip portal is: “Can someone take a loan using my details without my explicit permission and a mandate form?”

This blog post will delve into the security measures implemented by the CAGD to protect its system and employees, and clarify the process involved in securing a loan with direct deductions from your salary.

CAGD Loan Procedures and Security Measures

The Controller and Accountant General’s Department has put in place several safeguards to ensure that loan deductions are only authorized by the rightful employee. To have loan deductions processed directly through CAGD, the following criteria must be met:

- You must be a government worker.

- Your salary must be processed through the Controller and Accountant General.

- You must have a valid and verified CAGD E-payslip account.

- Your photograph must be validated within the system.

The Crucial Role of the Mandate Number and PIN

The key to understanding whether unauthorized loan applications are possible lies in the mandate number and, more importantly, the mandate PIN. Here’s a breakdown:

- Affordability Check: Before a mandate can even be generated, your affordability for the loan amount is assessed.

- Mandate Number Generation: While a third party might be able to generate a mandate number, this alone is insufficient to complete the loan process.

- The Security Key: Mandate PIN: The critical security layer is the mandate PIN. This unique PIN is sent directly to your registered mobile phone number.

- No PIN, No Loan: Without this PIN, the generated mandate number cannot be used to finalize the loan application and authorize deductions.

Therefore, to directly answer the question: It is virtually impossible for someone to take out a loan using your CAGD E-payslip details without a mandate number and, crucially, the mandate PIN sent to your phone. The only way someone could potentially bypass this security is if they have unauthorized access to your mobile phone and can intercept the SMS containing the mandate PIN.

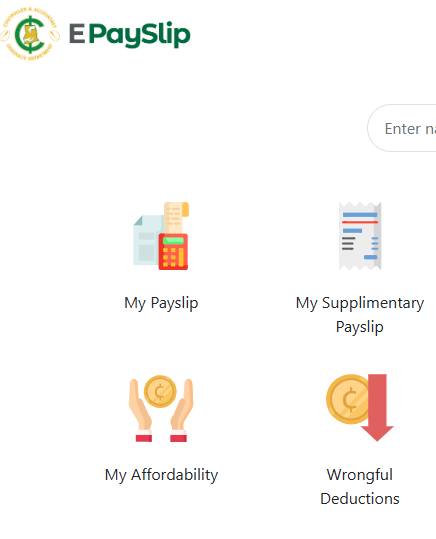

How to Generate Your Mandate Number (For Legitimate Loan Applications):

- Log in to your CAGD E-payslip portal.

- Locate the “Mandate Form” section.

- Click on “Generate Mandate”.

- Follow the on-screen instructions, which will involve receiving an SMS with your mandate PIN.

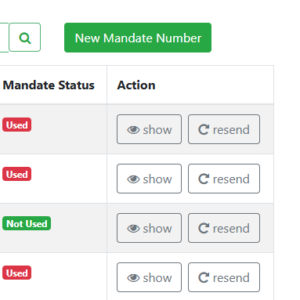

Mandate Status

When you click on mandate Form icon,

You will see the mandate status as to all the mandate forms and what they have been used for, whether Used or not used. Used means it has been used to generate a successful loan or deduction.

Check below

Security Advice for New Staff and All Users:

Protecting your CAGD E-payslip account is paramount. Here are some essential security tips:

- Never use someone else’s phone number to create your E-payslip portal. Your phone number is a critical security identifier.

- Be cautious when sharing your password. While loan officers might need it for viewing purposes, always change your password immediately after they have accessed your account.

- Avoid using the same password across multiple online platforms. This significantly increases your risk if one account is compromised.

- Be wary of unsolicited requests for your E-payslip login details or mandate PIN. Legitimate financial institutions will not ask for this information through unofficial channels.

Need Help with CAGD Loans?

For reliable assistance in connecting with reputable financial institutions for your CAGD loan needs, don’t hesitate to contact Seekers Consult 247.

The CAGD E-payslip portal has implemented robust security measures, particularly through the mandate PIN verification process, to protect government workers from unauthorized loan applications.

While generating a mandate number might be possible for a third party, the crucial mandate PIN, sent directly to your registered phone, acts as a significant barrier against fraudulent activities.

By adhering to the recommended security practices, you can further safeguard your financial information and ensure that only you can authorize loan deductions from your salary.

SHARE