GOG EPayslip Portal Monthly Check: Your Essential Guide to Reviewing Your Payslip -CAGD

Join our Telegram Channel for More Updates Click Here

CAGD Updates e-Payslip and ESPV Portals: Enhanced Security and New Features for 2026

The Controller and Accountant-General’s Department (CAGD) has rolled out significant updates to its Electronic Payslip (e-Payslip) and Electronic Salary Payment Voucher (ESPV) portals. This annual upgrade exercise appears more comprehensive this year, with a strong emphasis on tightening security, improving system reliability, and enhancing overall efficiency in public sector payroll processing.

The upgrades, which began in mid-January 2026, have temporarily affected access and functionality on both platforms. CAGD has confirmed that these changes aim to better protect employee data and streamline salary validation processes across government institutions.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

Key Changes and New Features

- Enhanced Security Measures: The updates include robust security improvements to safeguard sensitive payroll information and reduce vulnerabilities in the system.

- New Features for Validators in ESPV: Validators (such as HR officers and heads of management units) now have access to additional tools and functionalities. These enhancements are designed to make the monthly salary validation process more efficient and accurate.

While the e-Payslip portal (accessible at gogpayslip.com) is currently active, users may encounter limitations:

- Payslip generation and download features are not fully operational yet.

- The affordability certificate section still displays outdated information (e.g., December dates instead of January updates).

CAGD has assured affected users that payslip downloads will be restored very soon, and the affordability section will reflect the correct current data shortly.

Impact on January 2026 Salary Payments

Due to the ongoing system upgrade and validation challenges, CAGD processed January salaries in two batches:

- First batch: Paid to employees whose validators completed the process on time.

- Second batch: Handled as a supplementary payment for those impacted by delays.

Public sector workers are advised to check their bank accounts, as payments are being disbursed progressively.

Our Services ALSO includes

Call or WhatsApp us right now:

055 041 4552

055 041 4552

036 229 7079

036 229 7079

Our Services Include:

Our Services Include:

*ERRANDS SERVICES*

*RECOMMENDATION LETTER. ( UCC -REGULAR, SANDWICH AND DISTANCE)*

*UEW- REGULAR*

Research Proposal | Dissertation | Project Work

Research Proposal | Dissertation | Project Work

Assignments & Turnitin Plagiarism Check

Assignments & Turnitin Plagiarism Check

*Transcripts* (UCC, UG, KNUST, UEW, etc.) + Certificate Evaluation

*Transcripts* (UCC, UG, KNUST, UEW, etc.) + Certificate Evaluation

English Proficiency Tests

English Proficiency Tests

Biometric Birth Certificate (Express Service)

Biometric Birth Certificate (Express Service)

Affidavit (Done in 1 Hour!)

Affidavit (Done in 1 Hour!)

Gazette Publication

Gazette Publication

Passport Assistance

Passport Assistance

*Loan* Services for Government Workers

*Loan* Services for Government Workers

*PRINTING @0.35 front and Back*

We are physically here for you:

We are physically here for you:

– UCC Main Campus, Cape Coast

– UEW satellite

– KNUST satellite

– UDS, satellite

Don’t stress – let us handle it!

Call or WhatsApp us right now:

055 041 4552

055 041 4552

036 229 7079

036 229 7079

NEW SERVICE: Video Ads for Businesses!

NEW SERVICE: Video Ads for Businesses!

Send us details or let our team come shoot a professional video of your work/products and we’ll publish to grow your reach. Great deal!

Feel free to share with students, friends & family

Join our WhatsApp Channel for updates:

https://whatsapp.com/channel/0029VaCyYGIFHWpx22L38a2K

Guidance for Employees Without Salary Payments

If you have not received your January salary, do not panic—this may be linked to the upgrade, validation issues, or other administrative requirements. Affected individuals should promptly contact their Human Resource (HR) department or the relevant Accounts Office and submit the following documents to reactivate or resolve their salary status:

- Appointment letter

- Reposting letter (if applicable)

- Personal records form

- Ghana Card

- Current payslip (if previously issued)

- Application letter for salary reactivation

- Cover letter from your head of department or immediate supervisor

Providing these documents will help expedite verification and ensure your salary is processed in the supplementary batch or the next cycle.

Official Portals and Support

- e-Payslip Portal: www.gogpayslip.com

- ESPV Portal: www.gogspv.com

- For further inquiries, reach out to your MDA/MMDA HR unit or refer to CAGD’s official communications (often shared via their website at cagd.gov.gh or social media channels).

CAGD appreciates the patience of all public servants during this transition. These upgrades are part of ongoing efforts to modernize Ghana’s payroll system, minimize errors (such as unearned payments), and ensure timely, secure salary disbursements.

Stay updated through official CAGD channels for any further announcements. If you have questions or experiences to share about the update, feel free to comment below!

EPAYLSIP GOG PORTAL ; https://www.gogpayslip.com/index.php?action=login

-

.JOIN US

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

1. The Essential Payslip Deep Dive

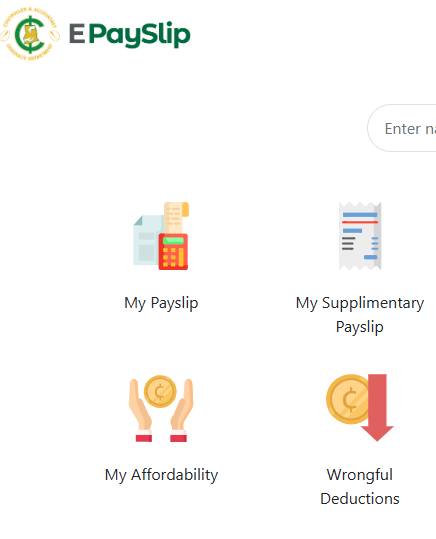

Upon logging into your portal, don’t just skim your payslip. Give it a thorough once-over:

- Your Rank and Responsibility Allowance: Confirm your current GRADE (e.g., Principal Superintendent) and any responsibility allowances (like HOD, House Master, Form Master, Chaplain) are correctly reflected. Don’t assume a change will automatically show up in your salary. Early detection allows for quicker resolution.

- Management Unit and Cost Centre: Verify your current place of work (Management Unit) is accurate. If you’ve been transferred and haven’t been validated at your new location, your salary payments could be disrupted. Double-check your COST CENTRE as well.

- Level and Point Progression: Track your LEVEL (e.g., SS.PSH17) and POINT progression. These should generally increase over time. If your point stagnates or, worse, decreases, it’s a red flag worth investigating. Note your SCALE TYPE (e.g., SS) for reference.

- Single Spine Salary and Allowances: Ensure your base salary and all entitled allowances are present and haven’t unexpectedly reduced.

- Income Tax Scrutiny: Keep an eye on your Income Tax deductions. A sudden, significant increase warrants investigation.

- Deduction Vigilance: Carefully review all deductions. If you have loan repayments deducted at source, monitor them to prevent over-deductions or the appearance of unauthorized new deductions.

- The Bottom Line: Finally, check your Total Gross Salary, total deductions, and the resulting Net Paid figure to your bank account. Does it align with your expectations?

- Tax Relief; Tax Relief when applied for is paid for a period of 12 months. If it’s not being paid contact CAGD

2. Investigating Potential Wrongful Deductions

Don’t just rely on your payslip. Actively check the “Wrongful Deductions” section:

- Month-by-Month Comparison: Select the specific month (e.g., April or May 2025) and year, then generate the report. Compare the deductions listed here with those on your payslip. Any discrepancies? This is where you can file a formal complaint directly through the system if you suspect an over-deduction.

3. Mandate Monitoring: Staying in Control

The “Generate Mandate” section requires your attention:

- Used vs. Unused Mandates: Review all generated mandates, whether used or not. Confirm the institution that utilized any mandate and ensure you authorized it.

- Suspicious Activity: If you spot a newly generated mandate that you didn’t initiate, even if it’s marked as unused, take immediate action. Change your password to a strong, unique one immediately.

- Be Aware of Your Surroundings: Sometimes, unauthorized actions can stem from those around you. Stay vigilant.

- Unsolicited Subscriptions: If you notice deductions or generated mandates for insurance or other services you never subscribed to, report it immediately.

4. Your Contact Information: A Critical Check

- Phone Number Verification: While changing your phone number isn’t straightforward, make it a monthly habit to confirm that the number listed in your profile is indeed yours.

A Word of Caution: Never, under any circumstances, use a friend’s, family member’s (including your spouse or child’s) details to create your payslip. This can lead to serious complications.

5. Association Integrity: Protecting Your Benefits

Navigate to the “Change Association” section:

- Confirm Your Affiliation: Even if your payslip shows your association, this area allows you to monitor if any unauthorized process has been initiated to change your current association.

- Long-Term Benefits: Remember that many associations base loan eligibility and amounts on your years of membership and contributions. Switching associations can significantly impact your future access to these benefits.

6. Password Prudence: Your First Line of Defense

- Regular Updates: While your password alone can’t directly harm you, it’s wise to change it periodically, especially if you suspect someone else might have access. Ensure you keep your password confidential.

The Power of Proactive Monitoring

This simple monthly routine on your GOG Epaylsip portal isn’t just about checking your salary. It’s about taking control of your financial well-being, identifying errors early, and safeguarding yourself against unauthorized activities. By dedicating a few minutes each month to these checks, you can save yourself significant time, stress, and potential financial losses down the line.

7. Picture Validation: Ensuring Secure Transactions

- Visual Confirmation: Your validated picture is often required for generating mandate forms for loans and other important transactions. Take a quick glance to ensure the displayed picture is indeed yours.

Make this monthly Epayslip portal check a non-negotiable part of your routine. Your financial peace of mind is worth it!

SeekersConsult247.

HOME

-

.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

I can’t open my payslips

It’s Everywhere