Understanding the CAGD GCB Personal Loan Chart: Eligibility, Process, and Charges Explained

This is for Informative purpose only. Kindly visit any branch of the Bank to ask questions or call their official Number.

Many government workers have questions about the personal loan options available through GCB Bank, especially those whose salaries are processed via the Controller and Accountant General’s Department (CAGD). If you’re looking for clarity on the CAGD GCB Personal Loan, eligibility, the application process, and associated charts or charges, this post aims to provide helpful information.

Let’s break down what you need to know.

The GCB Personal Loan

At its core, the loan offered to CAGD employees is a version of GCB Bank’s 24-Hour Personal Loan.

- What it is: A loan product designed specifically for salaried workers.

- Purpose: To help meet various personal, family, or household financial needs quickly.

- Speed: GCB aims to disburse these loans within 24 hours of approval.

Who Qualifies? (Target Market & Eligibility)

The GCB 24-Hour Personal Loan targets salaried workers from various sectors:

- Government Employees: Workers on the government payroll (like those processed by CAGD).

- Private Sector Employees: Staff from companies on GCB’s approved list, large corporations, and reputable companies known for low staff turnover.

Specifically for the “CAGD GCB Loan”:

- You must be a salaried government worker whose salary is processed by CAGD.

- Crucially, your salary must pass through an account at GCB Bank.

Key Loan Features

If you qualify, here’s what the GCB 24-Hour Personal Loan typically offers:

- Loan Amount: Up to GHS 700,000 (subject to affordability).

- Disbursement Time: Less than 24 hours upon approval.

- Debt Service Ratio (DSR): Up to 50% (meaning loan repayments shouldn’t exceed 50% of your net income).

- Loan Tenor: Up to 60 months (5 years).

- Insurance: Includes cover for Temporary/Permanent Disability, Death, or Retrenchment.

The Application Process: Step-by-Step

Applying for the loan involves these steps:

- Obtain the Loan Form: You can get this from any GCB Bank branch. Branch location doesn’t matter; they can assist you regardless of where you opened your account.

- Fill Your Details: Complete the personal information sections on the form.

- Institutional Approval:

- Get your Head of Institution (e.g., Headmaster/Headmistress for teachers) to fill their section and sign.

- Get your Accountant/Bursar/Accounts Officer to also fill their section and sign.

- Guarantor Form: This form must be completed by a colleague who also works with you and receives their salary through GCB Bank.

- Submit Payslips: Provide your last three (3) months’ payslips for income verification and loan calculation.

Important Clarification: Loan Deductions

This is a common point of confusion:

- How deductions work: GCB deducts the loan repayment directly from your GCB bank account after your salary has been paid into it by CAGD.

- What this means: Unlike some other loan types, the deduction will not appear directly on your CAGD payslip itself. The deduction happens at the bank level post-salary payment.

Affordability and Existing Loans

- Affordability Check: GCB uses an affordability calculation based on your income and existing deductions.

- Existing Loans Matter: If your payslip already shows significant deductions (loans, hires purchase, etc.), reducing your ‘affordable’ balance, you might not qualify for the amount you want, or potentially not qualify at all.

- Recommendation: It’s highly advisable to visit a GCB loan officer first. Discuss your situation and check your affordability before downloading or filling out forms.

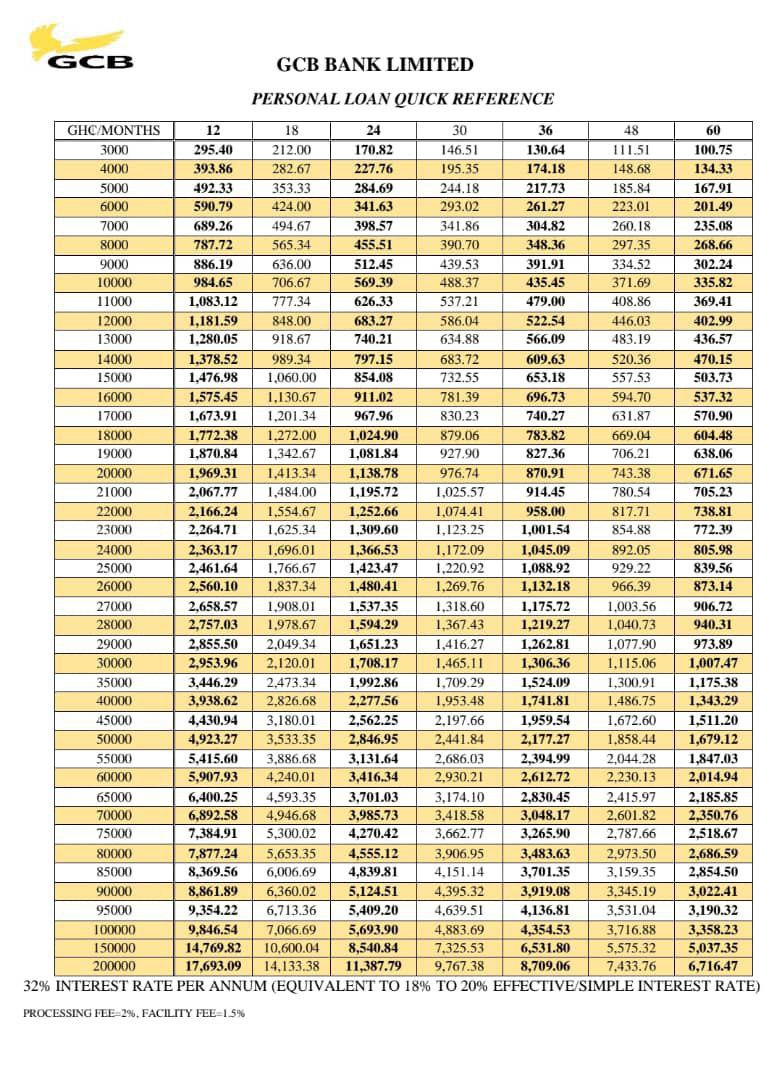

Loan Chart and Interest Rates: Seeking Current Information

Loan charts and interest rates change periodically based on market conditions and bank policy.

- Loan Chart: While we understand you’re looking for a chart, providing one here could quickly become outdated and misleading.

Check clearer file here

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

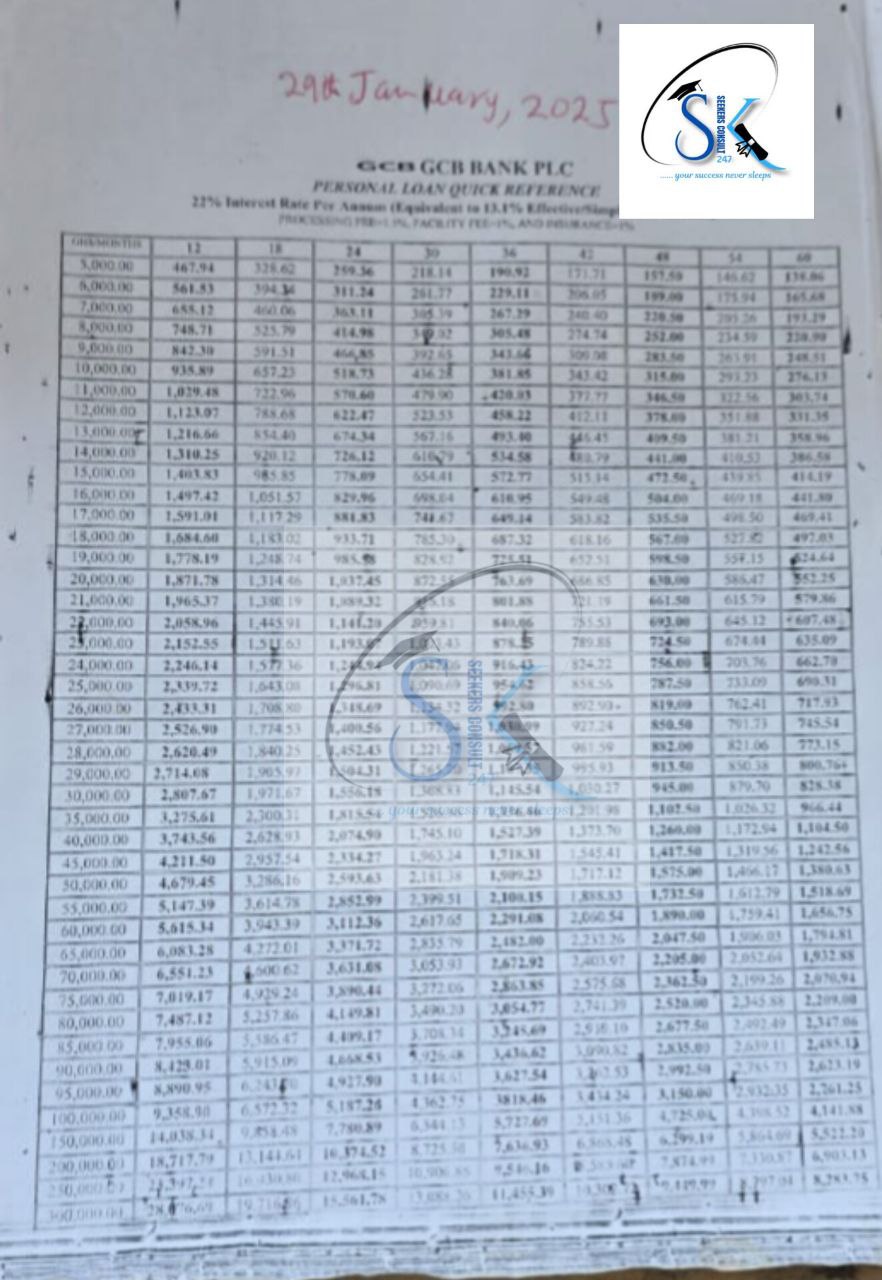

The Latest GCB Personal Loan chart January 2025

With Interest Rate reduced to %… check the image below

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

Follow us on Telegram [here]

- Interest Rate: The current applicable interest rate is crucial for calculating your repayment amount.

- How to Get Current Info:

- Visit a GCB Branch: Speak directly to a loan officer. This is the most reliable way.

- Check the GCB Website: Look for their official lending rates or personal loan product pages. GCB sometimes lists base rates or current indicative rates online (often found mid-page or in specific lending sections).

- Follow Reliable Updates: You mentioned a Telegram channel for updates – ensure it’s a trusted source.

GCB Loan Charges

Be aware of the standard fees associated with this loan:

- Processing Fee: 2% of the loan amount.

- Facility Fee: 1.5% of the loan amount.

(Always confirm current fees with the bank as these can also be subject to change).

Summary & Final Advice

The GCB Personal Loan offers a quick funding solution for eligible CAGD employees whose salaries pass through GCB. Understand the application process, how deductions work (post-salary payment from your account), and the importance of checking your affordability before applying.

Always get the most current Loan Chart, Interest Rate, and Fee information directly from GCB Bank.

Need Further Assistance?

For loan and related financial questions, you can connect with Seekers Consult 247 on 0550 414 552.

Follow us on Telegram [here] for discussions and potential updates on rates (always cross-verify with official GCB sources).