CAGD Loans for Government Workers in Ghana: Understanding Your Options and Avoiding Pitfalls

Have you received messages about “CAGD Loans” and the possibility of borrowing any amount you can afford as a government worker in Ghana? It’s understandable to be intrigued, but it’s crucial to understand the nuances surrounding these loan offers. This post aims to bring clarity to the term “CAGD Loans” and guide you through the different types of loans available to government employees, helping you make informed decisions and avoid potential pitfalls.

Understanding the Two Main Types of “CAGD Loans”:

The term “CAGD Loans” can be misleading as it doesn’t typically refer to direct loans provided by the Controller and Accountant-General’s Department (CAGD) itself for all government workers. Instead, it generally encompasses two distinct scenarios:

1. Loans from Financial Institutions with CAGD Deduction at Source:

This is the most common understanding of “CAGD Loans” for many government workers. It refers to loans offered by various financial institutions where the loan repayments are directly deducted from your salary by the CAGD before it’s paid into your personal bank account.

These financial institutions often include:

- Dalex Finance

- Bayport

- Leshego

- Societe Generale

- Izwe Ghana

- Fidelity Bank Ghana

- Some Rural Banks

-

Other Banks(with deductions upon salary hitting your account)

Important Considerations for These Loans:

- Direct Deduction: The convenience of automatic deductions from your payslip ensures timely repayment.

- Bank Account Requirements: Some banks, like GCB PLC, may require you to switch your salary account to them as a prerequisite for accessing their loan products. This necessitates a visit to your HR department to initiate a change of bank.

- Hidden Charges: Be extremely cautious of hidden charges such as processing fees and other costs that may not be explicitly mentioned by agents. Always demand a complete breakdown of all loan terms and costs before signing any agreement.

2. CAGD Staff Welfare Loans (Union Loans):

It’s important to note that employees working directly within the Controller and Accountant-General’s Department may have access to their own internal welfare loan schemes, often referred to internally as “CAGD Loans.” These are separate from the loans offered by external financial institutions to the broader public sector workforce.

When you hear the term “CAGD Loans,” understand that it most likely refers to loans offered by external financial institutions with repayment facilitated through CAGD deductions at source, rather than a direct loan from CAGD for all government workers.

The Loan Application Process and Avoiding Risks:

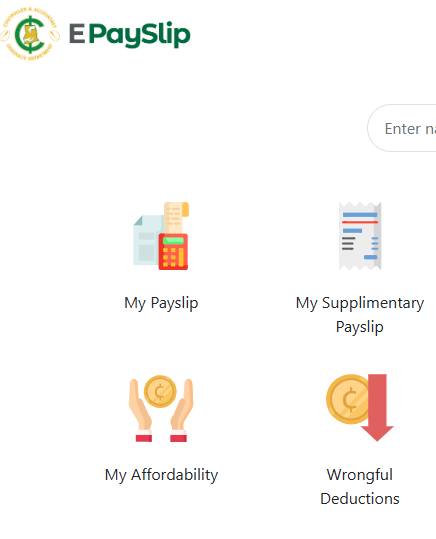

We understand that when you need money urgently, you might not always focus on all the security measures. While it’s true that accessing your e-payslip portal generally requires your password and involves multi-layered verification for significant changes, the real risk often lies with the lending institution itself.

Protect Yourself:

- Demand Transparency: Insist on a clear and comprehensive loan agreement outlining all charges, interest rates, repayment schedules, and terms and conditions. Don’t hesitate to ask for clarification on anything you don’t understand.

- Compare Offers: Don’t settle for the first offer you receive. Explore options from multiple financial institutions to find the most favorable terms and interest rates.

- Read the Fine Print: Carefully review all documentation before signing. Pay close attention to clauses regarding late payment penalties, default terms, and any other potential fees.

- Be Wary of Unrealistic Offers: If an offer seems too good to be true, it probably is. Be cautious of lenders promising excessively high loan amounts with minimal requirements.

Need Trusted Loan Advice? Contact Us

At Seekers Consult 247, we leverage our years of experience as loan officers to provide you with reliable advice and guidance on navigating the loan landscape for government workers. Contact us at 0550414552 for personalized assistance in understanding your loan options and identifying trusted lenders. We can help you calculate your affordability and ensure transparency regarding all potential charges.

Understanding the different facets of “CAGD Loans” is crucial for government workers in Ghana seeking financial assistance. By being informed about the types of loans available, the role of CAGD in the deduction process, and the potential risks involved, you can make smarter financial decisions and secure loans that genuinely meet your needs without hidden surprises.