Can I Take a Loan Without Affordability? And How to Increase Affordability

In Ghana, to take a loan—especially through the Controller and Accountant General’s Department—you need something called affordability. This is basically a portion of your salary, usually up to 40%, that must be available before a loan is approved.

Where Do You Check Your Affordability?

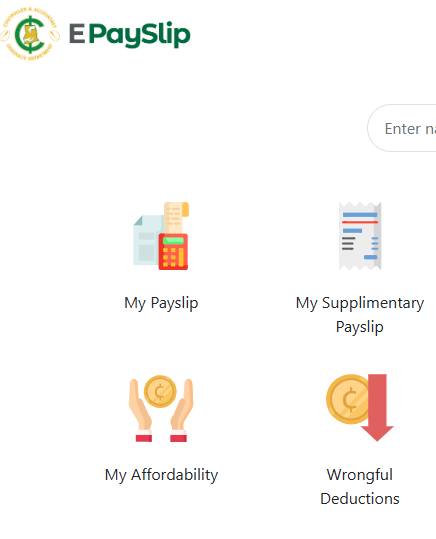

You can check your affordability on your ePayslip portal. There are two figures to look at:

-

Affordability Amount – this one usually looks high.

-

Affordability Margin – this is the important one. Sometimes you’ll see as little as 30 cedis left.

- Affordability Remaining: the portion you can use for loans and other transactions

This affordability covers deductions like:

-

Union dues

-

Insurance premiums

-

Loan repayments

Once your remaining affordability is finished, you can’t take another loan. It’s designed to make sure you have some disposable income left—so you don’t end up with zero salary.

The remaining 60% of your salary is what you use at home for living.

So Can You Take a Loan Without Affordability?

In most cases, No. but….

Most loan institutions (especially those under Controller) depend fully on your affordability to deduct money. If there’s none left, they won’t give you a loan.

Even the mutual funds, insurance, and all those little deductions also take from your affordability. So don’t joke with it. Affordability is not free money. It’s part of your salary.

But Wait… Some Banks Still Give Loans Without Affordability

Yes, there are exceptions.

-

Some Credit Unions will give you a loan without affordability, but they’ll ask you to deposit some money before they approve it.

-

Some banks (like GCB) will give you a loan based on the money that hits your account, not your affordability. They may give you about 60% of your net salary that goes into your bank account.

-

For big loans, you may need collateral. That’s your land, building, or car being used as security.

Follow us on WhatsApp for more updates: https://whatsapp.com/channel

Seekers Consult

Contact Us for Your Study Abroad Journey

We search for schools and check available scholarships for you

Contact: 0550414552 / 0362297079

Loan for government workers

Transcript Application

English Proficiency

Recommendation letter

Project work/thesis for undergraduate, master’s, and PhD students.

Apply for Affidavit, Gazette instantly

Passport and Visa Applications

All other Internet Services

How Do People Take Bigger Loans?

Here’s what some people do:

-

Take a bank loan based on their salary that hits their account.

-

Then take another loan that deducts from their affordability.

That way, they combine both loans to start a project or business with a substantial amount.

How to Increase Your Affordability

To increase your affordability:

-

Increase your salary (not easy, but possible through promotion or upgrading).

-

Reduce your deductions.

Some people even switch unions to those with lower dues just to free up affordability. After resolving their loan issues, they switch back to their preferred union.

Note: With Controller, you can only change unions once every 3 months.

Important Warning

Taking a loan is not a luxury. If things don’t go well, it can break you.

If you’re taking a loan for business, try having:

-

One big idea

-

One small idea

At least one may succeed, and you’ll have something coming in.

Also, don’t wait to get big money before you start something. Start small and grow it.

Coming Up Next…

In our next article, we’ll talk about some things you should never take a loan for—speaking from experience.